Finance and accounting teams are at the heart of all organisations. Managing revenue, third-party procurement, billing, supplier invoices, all while overseeing financial strategy and planning, mitigating risks and costs, and capitalising on new opportunities. Finance teams need to maintain high-performance levels, with minimal errors whilst pushing a business forward, which is why automation is becoming a popular choice among finance leaders looking to stay ahead of their competition.

The finance function is made up of numerous processes, most of which have a direct impact on the bottom line. However manual and laborious processes are causing a slow-down and dramatic decline in productivity. This is where automation comes in.

The benefits of automation technology for finance process automation are clear: increase productivity, improve security and boost efficiency and speed. Automation reduces errors, gives teams more control and visibility over the entire process, allows for more collaboration, all while adhering to strict compliance requirements.

In this article, we look at five time-consuming tasks finance professionals have to do on a daily basis that can be automated.

Manual data entry

Organisations depend heavily upon data to inform decision making, respond to change, and establish strategic goals. As firms take steps to gather more data at faster speeds, manual data capture simply cannot keep up with the processing demands.

Automating manual data entry reduces the error rate in your records and means that your team won’t have to deal with having documents in different parts of your system that clash. It makes it easier to track errors, and they only have to be fixed once. Making queries is simplified, reducing delays, and freeing up time for your finance team to focus on high-value work that is not suitable for automation.

Cross checking data on disparate systems

Much of the value in reporting comes from ensuring the right information is pulled together to provide clarity on the direction of the business. Using traditional reporting methods, finance teams must access data from other parts of the business – often housed in different systems – and then manually manipulate and reconcile the data into a consolidated report.

By integrating the systems used by different departments, automation makes it much easier for your team to follow the way money is spent. This means that it’s easier to control expenses and to anticipate when additional funding will be necessary so that budgets can be adjusted more smoothly over time.

Increased transparency reduces disagreement between departments and team members, making for an overall better working experience.

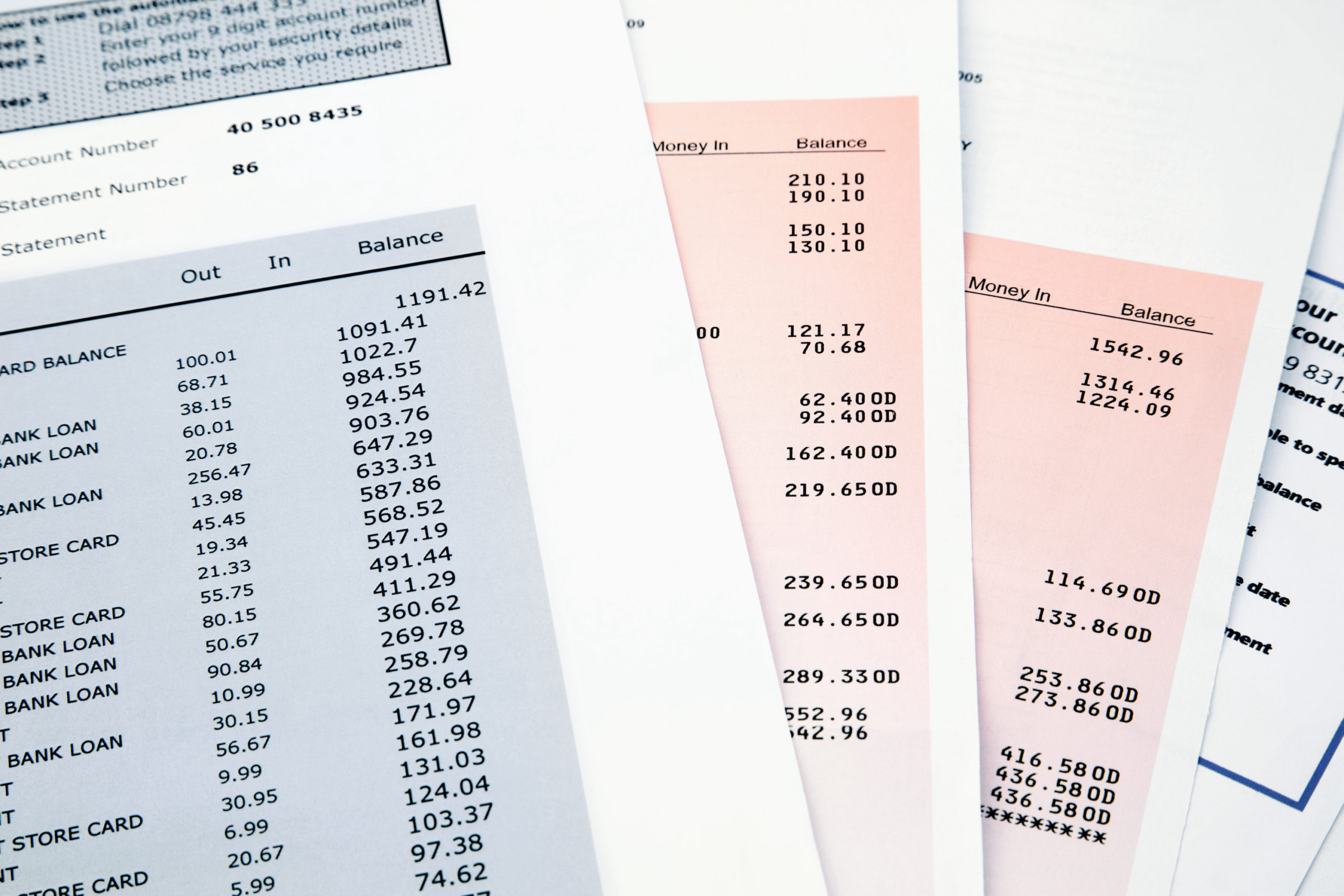

Supplier Invoices

Processing payments for finance departments is often a disorganised process with invoices coming in different formats: paper invoices, PDFs, emails – the list goes on. Seasonal peaks often mean a higher volume of invoices to be processed, and invoice capture using manual data entry during these times can result in lost documents and potentially reconciliation issues.

Automated invoicing leads to a faster payment process and reduces the risk of error. With Robotic Process Automation (RPA), software bots are used to execute the downstream processing, extracting data from documents and entering this into your organisation’s accounting system ensuring that supplier invoices are paid on time and without any errors.

Expenses

Traditionally, managing and tracking company expenses has been one of the most time-consuming processes. This is because expense management often involves a complicated number of steps, from employees collecting receipts and filling out expense reports, to managers forgetting to approve them, to the finance team reconciling everything and processing reimbursement. Overall, this process can be extremely inefficient.

By automating expense management, businesses can streamline operations, cut costs, and reduce tasks that waste time. Through automation, expense claims are paid on time, errors and fraud are eliminated, and business decisions are based on complete and accurate spend data.

Financial planning and analysis (FP&A)

Budgeting, forecasting, and management reporting are critical steps in ensuring companies make sound business decisions based on timely and accurate financial information. The FP&A department typically dedicates a disproportionate amount of time on sourcing, aggregating, and formatting data instead of on financial analysis and strategic planning.

By automating these manual data-related activities, you enable finance professionals to shift their focus to more value-added work. Because reports can be produced and compared quickly, it’s easier to identify anomalies that might otherwise have been overlooked. The integration that comes with automation will make it much easier for you to see your organisation’s overall financial position clearly and spot areas where things may be going wrong.

Business automation might sound like an overwhelming task and it’s a common misconception that automation is only for big enterprises. The reality is that automation simplifies daily tasks and it actually reduces operational costs in the long run. Also, a business of any size and nature can automate its processes and improve its performance significantly.

By implementing automation tools, you will free up your staff from having to devote large amounts of their day to manual tasks. Instead, they will be able to spend more time with their clients, offering high-value advice in areas such as personal and corporate taxation, R&D tax incentives and pension planning.

If you are considering automation or would like to learn more about how NexBotix can help you, please reach out to our team.